Content

There are several ways to trade forex, including trading spot forex, forex futures and currency options. When you trade with us, you’ll be predicting on the price of spot forex, futures and options either rising or falling with a CFD account. Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. This is why currencies tend to reflect the reported economic health of the region they represent. Central Bank and Government PolicyCentral banks determine monetary policy, which means they control things like money supply and interest rates.

Be aware though that leverage can increase both your profits and your losses. Forex is always traded in pairs which means that you’re selling one to buy another. Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. You’ll get access to award-winning platforms,8 expert support around the clock and spreads from just 0.6 points. The forex market is open 24 hours a day thanks to the global network of banks and market makers that are constantly exchanging currency.

Pip, which stands for “point in percentage,” is the lowest standardised movement that a currency quote can experience. Pips are a unit of measurement used by traders to describe their position’s profit or loss and to quantify the difference between the ask and bid prices of a currency pair. Individual retail speculative traders constitute a growing segment of this market. Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex.

What is Forex trading?

But there are drawbacks as well — such as leverage, which can be a double-edged sword in that it can amplify both gains and losses. “Without leverage, it’s a difficult market to make real money in,” Enneking says. You can set a closing limit order to automatically close out your trade if the asset you’re trading reaches a certain level of profitability. If you want to be assured of avoiding market slippage, then you can pay a small premium to place a “guaranteed stop-loss order”.

Take a look at the forex economic calendar for an indication of different factors which can impact the foreign exchange market. This will start to give you an idea of how changes in currency and the forex market work. The only thing is, when you trade on the forex market, you are making a similar transaction without the need of travelling. Forex traders are opening these position from home, or anywhere in the world, by using a forex trading account.

Money transfer/remittance companies and bureaux de change

The New York Stock Exchange, on the other hand, trades an average daily volume of just over $1.1 trillion. FX trading gives you the possibility of profiting from either side of the market; no matter if prices are rising or falling. Since trading currency pairs inherently means you are always buying one currency and selling it against the another, every trade will see you both short and long at the respective currencies at the same time. There are also lots of speculative transactions initiated on the foreign exchange market, by both large firms such as hedge funds, as well as the smaller retail traders. The foreign exchange market (Forex) is a global, decentralized market and is the world’s biggest financial market, with over $5 trillion worth of daily volume.

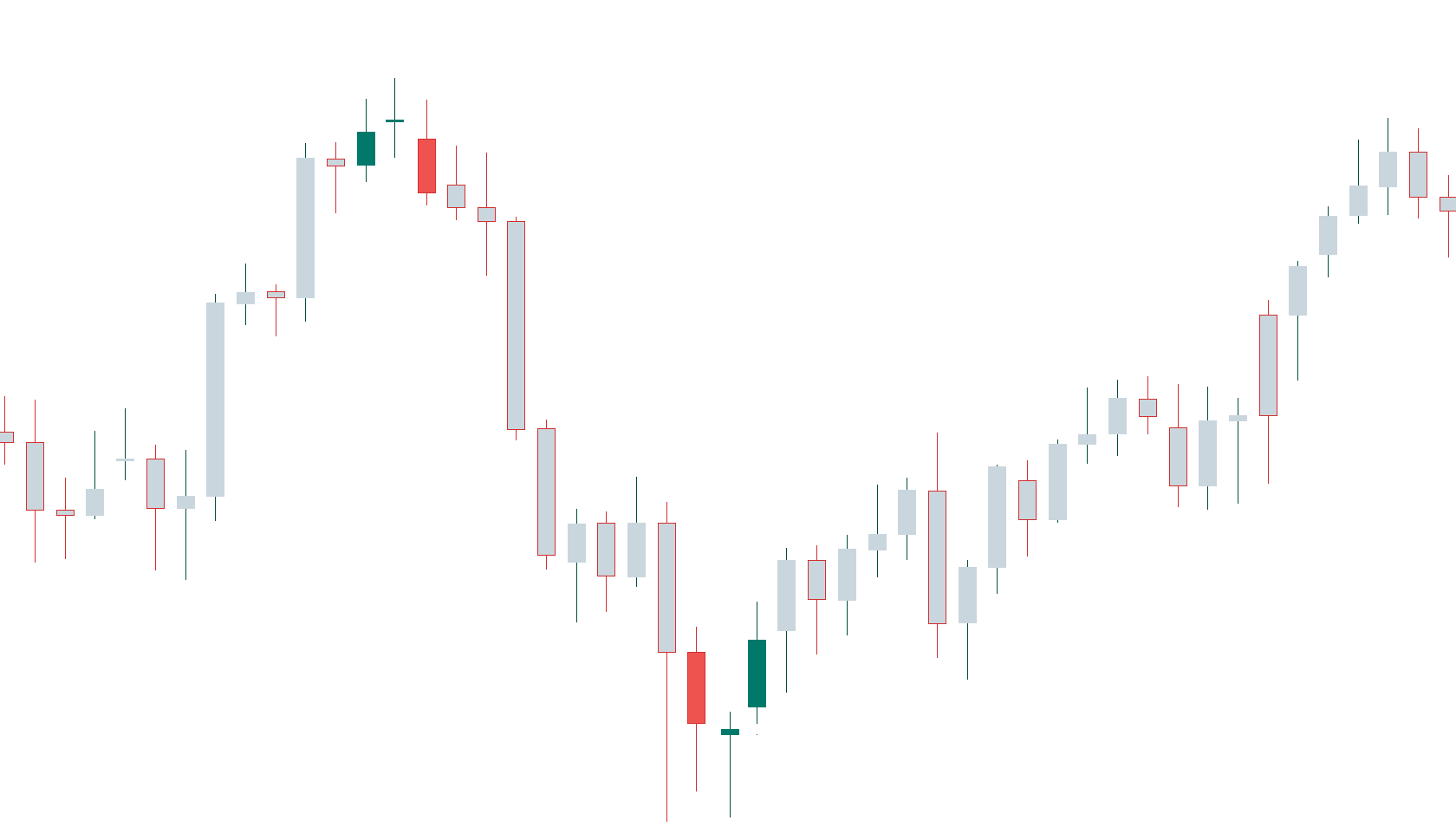

“You can easily trade using leverage which means that you need relatively little capital to be able to trade forex,” says Julius de Kempenaer, senior technical analyst at StockCharts.com. The MT4 Trading platform is widely used and is establishing standards for the whole industry. The majority of Brokers use the MT4 trading platform to offer forex trading. This trading platform was launched in 2005 by a company called MetaQuotes. Even though the same business creates the MT5, MT4 is more commonly used. Forex charts are essential to understanding the movement of the currency markets.

Central Banks

But when selling a currency pair, you anticipate the price to fall, weakening the base currency against the quote currency. The exchange rate will tell you how much of the quoted currency you need to buy one unit of the base currency. For this reason, the base currency is always expressed as one unit, while the quote currency varies based on the market. For the large majority of currency pairs, a Pip is the 4th decimal place. The largest quoted currencies – like EUR/USD and USD/JPY – are floating.

- The main aim of forex trading is to successfully predict if the value of one currency will increase or decrease compared to the other.

- Margin is a double edged sword, since it can amplify gains as well as losses.

- It’s a small movement, and it may be the smallest measurable movement, although some brokerages may measure partial pip movements.

- Rising prices are represented by X columns, and falling prices are represented by O columns.

- Paying in Brazilian real can eliminate this premium and so may reduce your costs.

Your broker will “lend” you a certain percentage of a given position’s value, with your own funds being used as a deposit – this deposit is called margin. With AUD/SGD, AUD is your base currency and SGD is your quote currency and you would need $1.04 Singapore dollars to purchase one unit or dollar of Australian dollars. These bodies set standards for all traders to abide by, such as being registered, licensed, and undergo regular audits. The availability of leverage will tempt you to use it, and if it works against you, your emotions will weigh on your decision-making, and you will probably lose money. The best way to avoid all of this is to develop a trading plan that you can stick to, with methods and strategies you’ve tested and that result in profitable trades at least 50% of the time. Some US-based businesses buy from foreign partners in US dollars because they believe this will help them avoid extra costs.

This is called a margin account which uses financial derivatives like CFDs to buy and sell currencies. An online forex broker acts as an intermediary, enabling retail traders to access online trading platforms to speculate on currencies and their price https://g-markets.net/helpful-articles/bullish-harami-candlestick-pattern/ movements. The Forex market determines the day-to-day value, or the exchange rate, of most of the world’s currencies. If a traveler exchanges dollars for euros at an exchange kiosk or a bank, the number of euros will be based on the current forex rate.

How to learn forex trading?

What I’m trying to say is that when you trade stocks with a small account and you’re buying a small number of shares, fixed transaction costs will eat into a huge percentage of your returns. You may pay transaction costs depending on how your broker wants to charge you. But typically, you don’t have to pay transaction costs In Forex trading. Markets are usually moved by the big players which I shared with you at the top of the food chain. But you as the retail trader, you only have access with the connection with the market maker who then might pass on your order to the bank connection directly.

As the exchange rate rises, the base currency increases in value, giving you better chances to buy more USD with 1 EUR. What this is telling us is in the market right now you can sell 1 euro and buy about this number of dollars. A standard lot is equal to 100,000 units of the base currency in a forex trade pair. The official hours are from 5 pm EST on Sunday until 4 pm EST on Friday. EST refers to the time zone that is occupied by cities including New York, Boston, Atlanta, Orlando in the US, and Ottawa in Canada (to name a few).

These represent the U.S. dollar (USD) versus the Canadian dollar (CAD), the euro (EUR) versus the USD, and the USD versus the Japanese yen (JPY). Rather, the forex is an electronic network of banks, brokerages, institutional investors, and individual traders (mostly trading through brokerages or banks). The forex market represents a trading volume of $4 trillion per day, which makes it easier for you to get in and out of the trades at any time.

You will also learn about quotes, including the bid and ask price, and how the spread impacts your trades. Additionally, you will get a detailed understanding of how to buy and sell currencies through a forex broker and how to speculate on the movement of currency exchange rates. By the end of these sections, you will have a strong base in the fundamentals of forex trading. Foreign exchange traders try to profit on movements in the market price between foreign currencies.

Compared to crosses and majors, exotics are traditionally riskier to trade because they are more volatile and less liquid. This is because these countries’ economies can be more susceptible to intervention and sudden shifts in political and financial developments. The base currency is the first currency that appears in a forex pair and is always quoted on the left. This currency is bought or sold in exchange for the quote currency and is always worth 1.

Currencies are traded worldwide in the major financial centers of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich—across almost every time zone. This means the forex market begins in Tokyo and Hong Kong when the U.S. trading day ends. As such, the forex market can be highly active at any time, with price quotes changing constantly. Combine tools with MetaTraderThe platforms contain a huge variety of tools, indicators and charts designed to allow you to monitor and analyse the markets in real-time. You can even build strategies to execute your trades using algorithms. You can read more and download the trading platforms from our trading platforms page.

- Leverage works a bit like a loan and lets you borrow money from a broker so that you can trade larger amounts of currency.

- However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses.

- Because so much of currency trading focuses on speculation or hedging, it’s important for traders to be up to speed on the dynamics that could cause sharp spikes in currencies.

These pressing questions make sense, especially if you want to explore Forex trading and earn from it. Simply answer a few questions about your trading preferences and one of Forest Park FX’s expert brokerage advisers will get in touch to discuss your options. Don’t get confused when you see a currency quoted, it is not always the last number that is the Pip – our example deal ticket had five decimals. It doesn’t matter how many decimals are displayed – a Pip is still the fourth decimal.

Forex (FX): How Trading in the Foreign Exchange Market Works

But, with the rise of online trading, you can buy and sell currencies yourself with financial derivatives like CFDs, so long as you have access to a trading platform. This is because all forex trades are conducted over-the-counter (OTC), rather than on exchange like stocks. Forex prices determine the amount of money a traveler gets when exchanging one currency for another. Forex prices also influence global trade, as companies buying or selling across borders must take currency fluctuations into account when determining their costs. Inevitably, the forex has an impact on consumer prices, as global exchange rates increase or lower the prices of imported components.