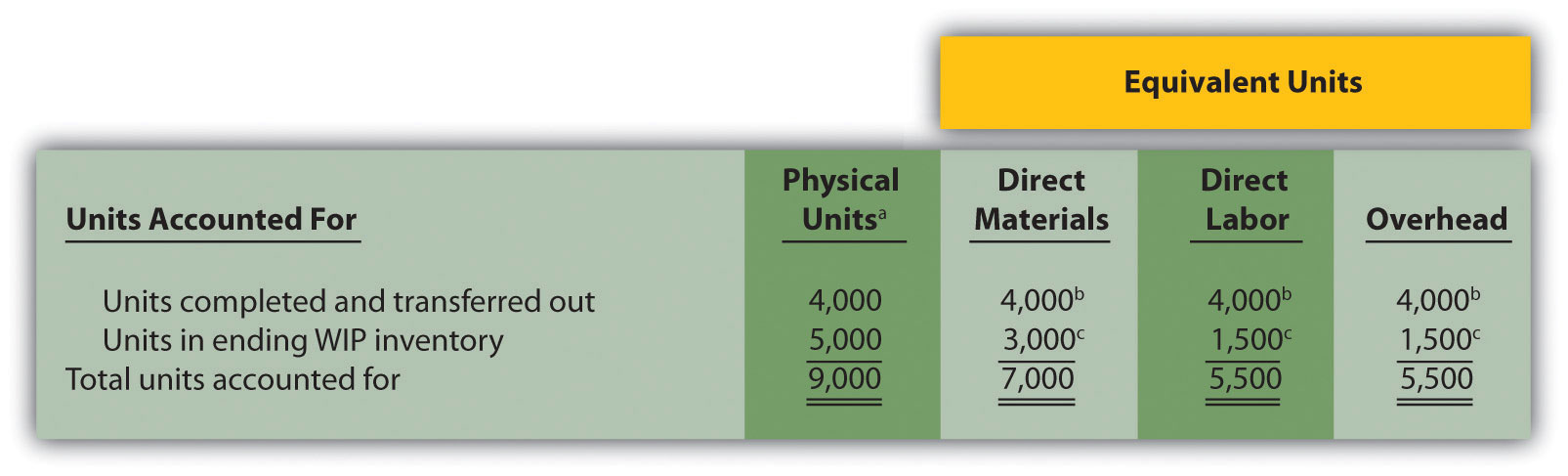

As you examine the diagram, think of the amountof water in the glasses as costs that the company has alreadyincurred. Essentially, the concept ofequivalentunits involves expressing a given number ofpartially completed units as a smaller number of fully completedunits. We do this because it is easier to account for whole unitsthen parts of a unit. For example, if we have 3 units 1/3 ofthe way complete, we can add them together to make 1 equivalentunit (1/3 + 1/3 + 1/3). We can make this calculation easier bymultiplying the units by a percentage of complete. Conversion costing is the cost spent to turn raw materials into finished products.

Would you prefer to work with a financial professional remotely or in-person?

We do the same of ending work in process but using the equivalent units for ending work in process. We have 4,000 total units for which to account, with 750 in process at the beginning of the month, and the last batch that is still in process at the end of the month will be 1,000 shells once it is done. On the last day of February, it was only 25% through the process, meaning that the EUs for ending inventory for direct materials was 1,000 units and for conversion costs was 25% of 1,000 units which is 250 EUs. In the example, the cost per equivalent unit for direct materials is 10.00, cost per equivalent unit for direct labor is 4.00, and the cost per equivalent unit for manufacturing overhead is 1.50. The objective of using equivalent units is to be able to apportion the costs of production to completed units and partially completed units held in work in process.

Step 3 – Divide costs by equivalent units

A complete production cost report for the shaping department is illustrated in Figure 8.71. Establish the total inventory in production by adding units started into production to beginning work in process (what was left only partially finished at the end of the prior month). The company had 750 shells in process at the close of business on January 31.

Step Three: Determining the Cost per Equivalent Unit

Essentially, the concept of equivalent units involves expressing a given number of partially completed units as a smaller number of fully completed units. We do this because it is easier to account for whole units then parts of a unit. For example, if we have 3 units 1/3 of the way complete, we can add them together to make 1 equivalent unit (1/3 + 1/3 + 1/3). We can make this calculation easier by multiplying the units by a percentage of complete.

At the end of process 1, our planners have their paper and ink ready to be printed. Let’s assume we figure the ending WIP inventory to be 35% complete as to the process. If we have 1000 units in the ending WIP inventory after process 1, this would equal 350, using the formula for equivalent units. We could then add these equivalent units to the ending WIP inventory for process 1.

Calculating Inventory Transferred and Work in Process Costs

Accountants often assume that unitsare at the same stage of completion for both labor and overhead.Accountants call the combined labor and overhead costs conversioncosts. Conversioncosts are those costs incurred to convert rawmaterials into the final product (meaning, direct labor andoverhead). taxable and tax exempt interest income For example, a factory is making chocolate bars and they have 200 bars that are halfway done at month-end. Instead of counting these as 200 incomplete bars, we use equivalent units to measure them. Since they are halfway done, it’s like having 100 fully completed chocolate bars.

- From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640.

- Establish the total inventory in production by adding units started into production to beginning work in process (what was left only partially finished at the end of the prior month).

- We want to make sure that we have assigned all the costs from beginning work in process and costs incurred or added this period to units completed and transferred and ending work in process inventory.

- No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections.

- For example, let’s assume that a company manufactured 2000 motorcycles for this year and 30% of motorcycles were lost due to defects.

Once the equivalent units for materials and conversion are known, the cost per equivalent unit is computed in a similar manner as the units accounted for. The costs for material and conversion need to reconcile with the total beginning inventory and the costs incurred for the department during that month. FIFO, WA, and EU are all tools used to calculate the cost of producing products.

Without this, we can’t assign costs to products in different stages of completion, so we won’t know the true costs at period end. If the closing work-in-progress is 800 units, 70% complete in all respects, the equivalent units of production of closing work-in-progress is 560 units (i.e., 800 x 70%). Because we calculated EUs based on completed units, including EUs that represent the effort it took to complete the beginning inventory, we divide ONLY costs added during the period by our Equivalent Units. At the start of an accounting period a business has 2,000 units in beginning work in process. During the accounting period a further 8,000 units are added to the production process and 6,000 units are completed and transferred out, leaving an ending balance of 4,000 units in work in process. For total EU, this is the sum of the beginning inventory, the units started and completed, and the units still in the ending inventory.

Equivalent units help measure the production activity by converting partially completed products into an equivalent number of fully completed products. The FIFO method uses these equivalent units by assigning the oldest costs to the units completed first, which helps track costs in the order they were incurred. The Weighted-Average method, on the other hand, averages out all the costs over the period, using equivalent units to find a single cost per unit for both completed and partially completed products. Together, equivalent units and the chosen method (either FIFO or Weighted-Average) help companies accurately calculate production costs.

The only direct material added in the packaging department for the 5A sticks is packaging. The packaging materials are added at the beginning of the process, so all the materials have been added before the units are transferred out, but all of the conversion elements have not. As a result, the number of equivalent units for material costs and for conversion costs remaining in ending inventory is different for the testing and sorting department.