Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management. Both variables are shown on the balance sheet (statement of financial position). These calculations are fairly advanced, and you probably won’t need to perform them for your business, but if you’re curious, you can read more about the current cash debt coverage ratio and the CCC.

Bankrate logo

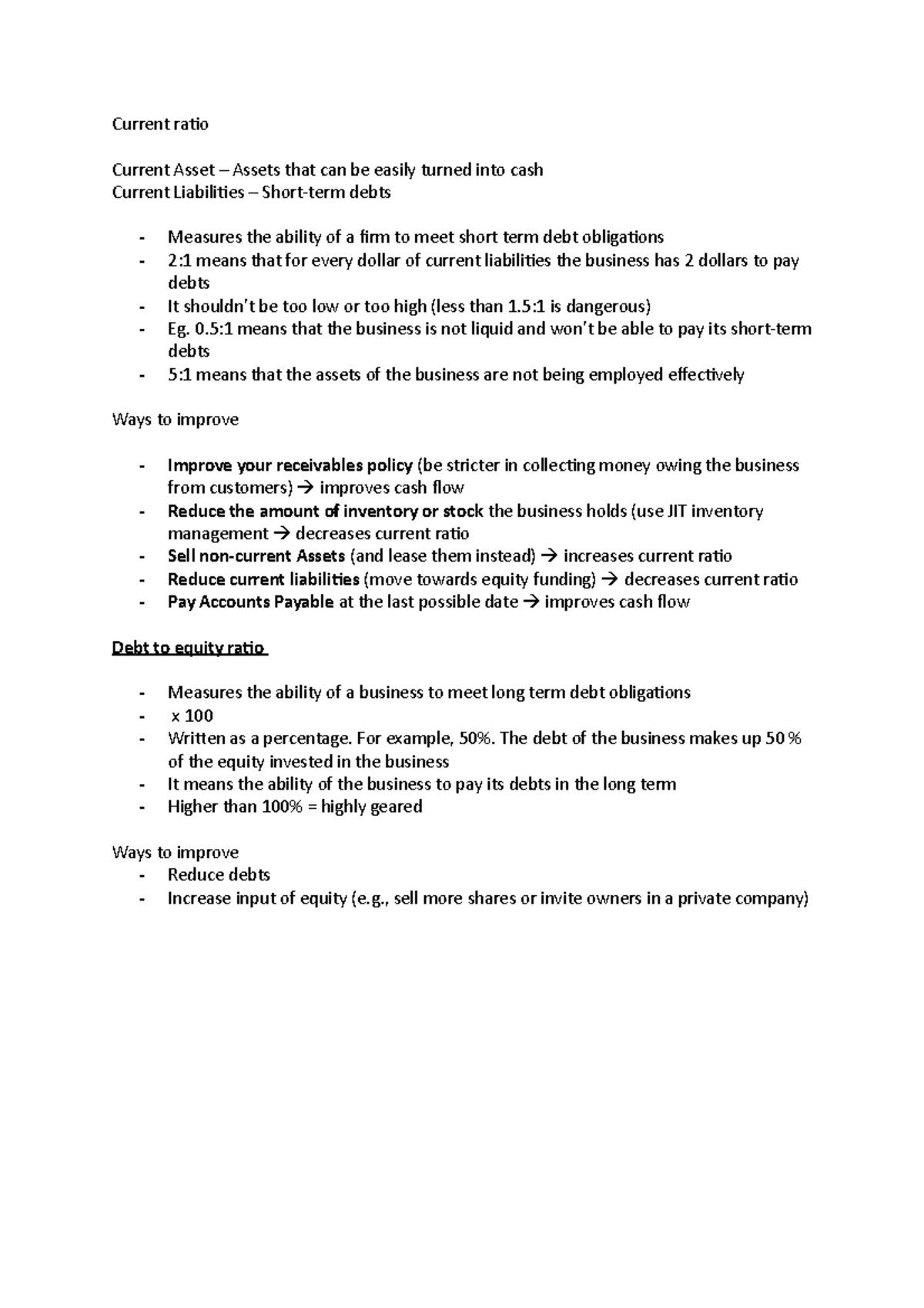

Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital. The current ratio also sheds light on the overall debt burden of the company. If a company is weighted down with a current debt, its cash flow will suffer. A ratio greater than 1 means that the company has sufficient current assets to pay off short-term liabilities. Companies with shorter operating cycles, such as retail stores, can survive with a lower current ratio than, say for example, a ship-building company. The current ratio should be compared with standards — which are often based on past performance, industry leaders, and industry average.

Company

- The liquidity-profitability tradeoff has been a long-standing debate in the finance literature.

- To calculate the current ratio of a U.S. company using its balance sheet, you must first determine its current assets and current liabilities.

- An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio.

- There’s another common ratio used to look at a company’s liquidity — the quick ratio.

- Both circumstances could reduce the current ratio at least temporarily.

A current ratio below 1 means that current liabilities are more than current assets, which may indicate liquidity problems. If a company has $2.75 million in current assets and $3 million in current liabilities, its current ratio is $2,750,000 / $3,000,000, which is equal to 0.92, after rounding. Clearly, the company’s operations are becoming more efficient, as implied by the increasing cash balance and marketable securities (i.e. highly liquid, short-term investments), accounts receivable, and inventory. Companies with a healthy current ratio are often viewed as being more creditworthy and better able to meet their short-term obligations. Another ratio interested parties can use to evaluate a company’s liquidity is the cash ratio.

Current Ratio vs. Quick Ratio

The cash asset ratio, or cash ratio, also is similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities. This ratio compares a company’s current assets to its current liabilities, testing whether it sustainably balances assets, financing, and liabilities. Typically, the current ratio is used as a general metric of financial health since it shows a company’s ability to pay off short-term debts. The current ratio is a metric used by accountants and finance professionals to understand a company’s financial health at any given moment. This ratio works by comparing a company’s current assets (assets that are easily converted to cash) to current liabilities (money owed to lenders and clients).

Current ratio is equal to total current assets divided by total current liabilities. The current ratio is 2.75 which means the company’s currents assets are 2.75 times more than its current liabilities. Current ratio (also known as working capital ratio) is a popular tool to evaluate short-term about form 1094 solvency position of a business. Short-term solvency refers to the ability of a business to pay its short-term obligations when they become due. Short term obligations (also known as current liabilities) are the liabilities payable within a short period of time, usually one year.

Your current liabilities (also called short-term obligations or short-term debt) are:

It all depends on what you’re trying to achieve as a business owner or investor. In actual practice, the current ratio tends to vary by the type and nature of the business. Everything is relative in the financial world, and there are no absolute norms. If a company has a current ratio of 100% or above, this means that it has positive working capital. The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business. On the other hand, the current liabilities are those that must be paid within the current year.

Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room. A current ratio lower than the industry average could mean the company is at risk for default, and in general, is a riskier investment. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition. But a too-high current ratio may indicate that a company is not investing effectively, leaving too much unused cash on its balance sheet. If a company’s current ratio is less than one, it may have more bills to pay than easily accessible resources to pay those bills. For example, a company may have a very high current ratio, but its accounts receivable may be very aged, perhaps because its customers pay slowly, which may be hidden in the current ratio.

So, things like inventory, which can be liquidated but may take more than 90 days to do so, are generally excluded, making the quick ratio a much more conservative approach to liquidity. Note the growing A/R balance and inventory balance require further diligence, as the A/R growth could be from the inability to collect cash payments from credit sales. Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1.