Whether you’re trying to promote your brand-new product, stay ahead of your competitors, or cut down on your expenses, you need to have a strategy in place. This helps you craft a more formidable strategy and reap better benefits for your company. Fixed costs are costs that are incurred by an organization for producing or selling an item and do not depend on the level of production or the number of units sold. Some common examples of fixed costs include rent, insurance premiums, and salaries. You can see that all of these costs do not change even if you increase production or make more sales in a particular month.

Break even formula

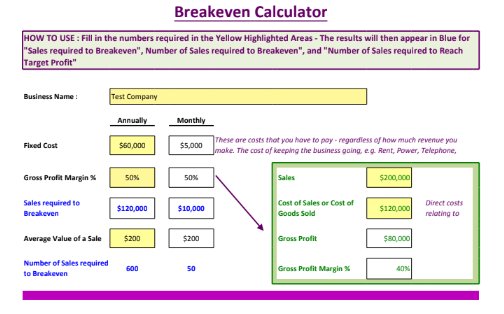

Take note of expensive and unnecessary costs that you can reduce. You might need to look for a more affordable space to rent, or rethink a more cost-effective marketing strategy. In other cases, you may need to find a new contractor who can give you lower rates for maintenance services. When you’re running a business, finding ways to minimize these costs is crucial in making your business profitable. Given your profit margin, it is important to know how many units of a certain product that you will need to sell in order to cover your fixed/startup costs.

Call Option Breakeven Point Example

- The break even analysis helps you calculate out your break-even point.

- For options trading, the breakeven point is the market price that an underlying asset must reach for an option buyer to avoid a loss if they exercise the option.

- In addition, changes to the relevant range may change, meaning fixed costs can even change.

- Depending on your business, transportation and travel can take a big portion of your business expenses.

External circumstances, like trade agreements and changes in the political climate, have an impact on your sales. In such cases, break-even analysis will help understanding cash flow statement vs income statement you to decide on new prices for your products. Calculating the break-even point helps you determine how much you will have to sell before you can make profit.

Adjust the Unit Selling Price of the Product

On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90. If you’re looking to purchase a specific machine or a truck for your business, consider taking an equipment loan. This type of financing provides some of the lowest interest rates, especially if you take your loan from a traditional bank.

When more customers are happy with your product and service, the more they will recommend your product to other people. Either way, you should have an effective means to track if your campaigns are generating awareness. You can monitor this by checking analytics for pay-per-click ads. If your campaign has been on for a few months with hardly any improvements to your sales, it’s likely better to cancel them. At the end of the day, it’s a waste to keep paying for ineffective ads.

Break-even analysis: Calculating the break-even point to gain financial insights

It makes the difference from operating at a loss to achieving financial goals and expanding production. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Divide 1.03 by 1.01, and subtract one, and the break-even rate of 1.98% represents the average annual inflation rate that would leave the two bonds equal at maturity. Even though break-even analysis can help forge a path to profitability, it’s not a perfect analytical tool. Once you’ve decided whether you want to find your break-even point in sales dollars or units, you can then begin your analysis.

But even with a small business, it’s crucial to keep your inventory organized. Make sure to prioritize having an efficient inventory software to monitor your goods. You should know the status of your products from production and storage, all the way to delivery and retail. A reliable inventory system also informs you when your products tend to sell well throughout the year.

For options trading, the breakeven point is the market price that an underlying asset must reach for an option buyer to avoid a loss if they exercise the option. The breakeven point doesn’t typically factor in commission costs, although these fees could be included if desired. Now, as noted just above, to calculate the BEP in dollars, divide total fixed costs by the contribution margin ratio. To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Increasing Production Costs – In other cases, demand for your product may remain the same or stay steady. However, the cost of producing your product is likely to increase over time.